Our Blog

What Is Indexed Universal Life Insurance (IUL) and How Does It Work?

If you’re exploring ways to build long-term wealth, protect your family, and plan for retirement, you may have come across the term Indexed Universal Life Insurance or IUL for short. But what is it exactly, and why are so many people choosing it as part of their financial strategy?

In this article, we’ll break down what an IUL policy is, how it works, and whether it could be the right fit for your future goals.

What Is Indexed Universal Life Insurance (IUL)?

Indexed Universal Life Insurance is a type of permanent life insurance that offers flexible premiums, lifetime coverage, and a cash value component that grows over time.

Unlike traditional life insurance, an IUL allows you to earn interest based on the performance of a stock market index, without actually being invested in the market.

The major benefit? Your policy has built-in protection from market losses, so while your cash value can grow during good market years, it won’t decrease when the market takes a dip.

How Does an IUL Work?

When you make a payment toward your IUL policy, part of that payment goes toward the life insurance coverage (the death benefit) and the rest goes into the cash value account, which grows tax-deferred.

The cash value earns interest based on a market index, but with a floor (typically 0%) and a cap. That means:

If the market goes up, your cash value earns interest (up to the cap).

If the market goes down, your cash value stays protected, it won’t lose value.

Over time, this cash value can become a powerful tool you can borrow against tax-free, use for retirement income, or tap into for major life expenses, like college tuition or a home down payment.

IUL vs. 401(k) and Traditional Savings

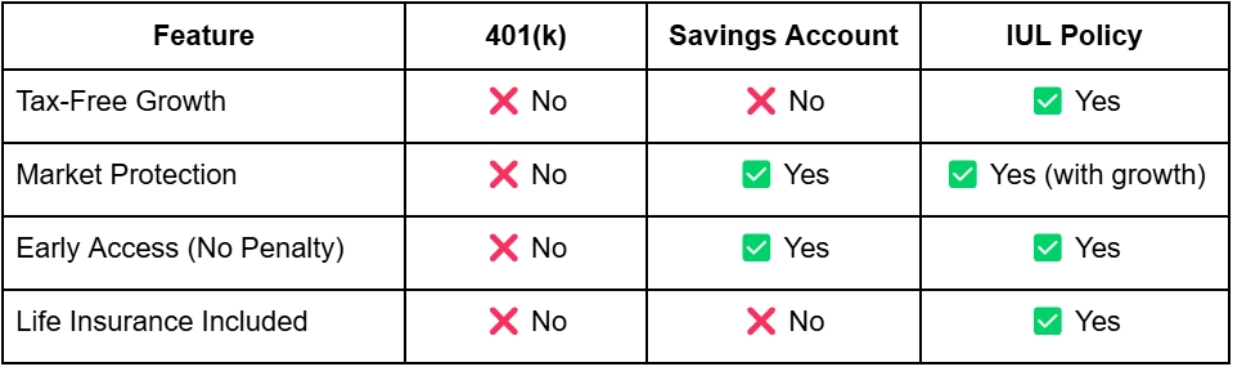

When compared to more common options like a 401(k) or savings account, IUL policies offer a unique mix of protection, growth, and accessibility:

Who Is an IUL Best For?

An IUL policy may be a great fit if you:

Want to build tax-free retirement income

Need life insurance coverage

Like the idea of protecting your money from market crashes

Want access to your cash value for emergencies or big milestones

Prefer a long-term, low-risk savings strategy

Is an IUL Expensive?

One of the biggest myths about IULs is that they’re only for the wealthy. In reality, an IUL policy can be tailored to your budget. Some people start with as little as $50–$100 per month. The cost depends on factors like your age, health, and financial goals, but the earlier you start, the more you can benefit from compounding growth.

Final Thoughts: Is an IUL Right for You?

An IUL isn’t just life insurance, it’s a powerful financial planning tool that offers tax advantages, flexibility, and protection for you and your family.

If you’re looking for a way to secure your future while still enjoying your life today, this strategy might be worth exploring.

Want to Learn More?

Secure Tomorrow is here to help you understand your options and find the right IUL plan for your needs.

FAQ's

What is Mortgage Protection Insurance?

Mortgage protection insurance is designed to pay off your mortgage in the event of death or critical illness. It was created to prevent your family from loosing their home, due to the inability to make your mortgage payments.

Why do I need Mortgage Protection Insurance as a new homeowner?

Mortgage Protection Insurance protects your most important investment, your home. Mortgage protection will provide your family with a peace of mind knowing that if something where to happen they would be protected.

How are the Mortgage Protection Plans customized for me?

Mortgage protection plans can be customized to fit your specific needs and circumstances. Protect My Home Now agents work with over 30 carriers to offer you with the best plans that work for your needs and budget.

What types of events are covered by Mortgage Protection Insurance?

Mortgage Protection Insurance covers many of life's unforeseen circumstances such as death, disability, critical illness, and terminal illness.

How do I get started with Protect My Home Now?

To get started with Protect My Home Now please fill out our form and one of our state licensed insurance agents will reach out to you to go over your options.